When the real estate market showed signs of softening after 2018, there was a lot of talk about an upcoming recession. Fortunately, recent data from the California Association of Realtors (CAR) shows that it’s not all doom and gloom for 2020. In fact, there are reasons to be optimistic as we begin the new year and a whole new decade. Here are some takeaways:

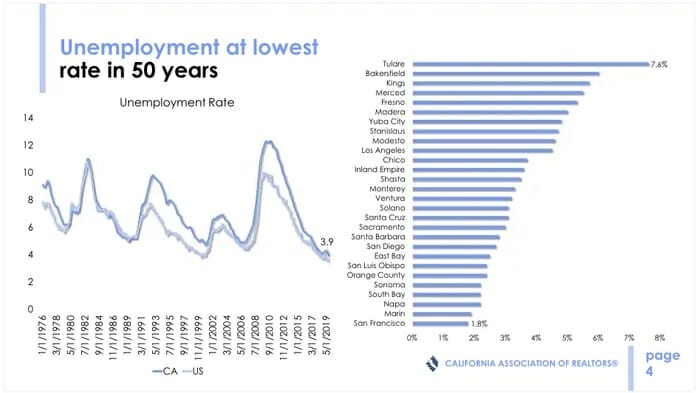

Unemployment is at historically low levels, especially in the Bay Area.

Unemployment rates in California, and notably the Bay Area, are hovering in the 2 percent range, which is a great sign for the local economy. A strong job market increases the odds that Bay Area residents can fulfill the American dream of owning their own home.

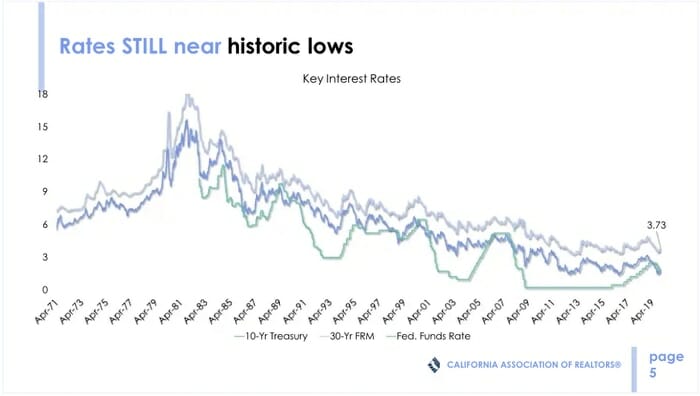

Interest rates are still historically low.

Interest rates are still at historically low levels, below 4 percent, which makes home buying more affordable for more residents.

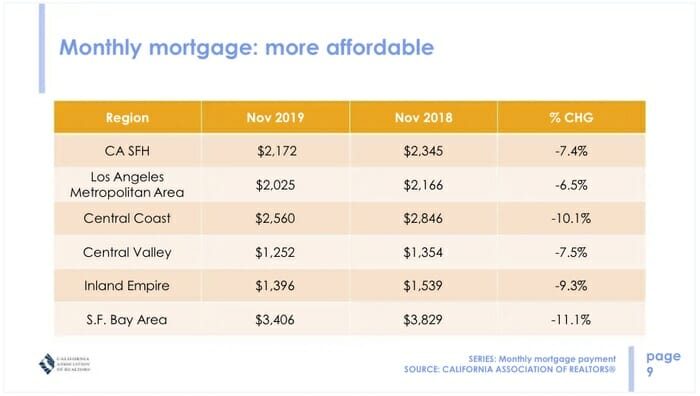

Monthly mortgage payments are more affordable than last year.

In the San Francisco Bay Area, the average monthly mortgage payment is 11 percent lower than it was last year.

There is a softening in the Bay Area real estate market, but it’s not terrible.

While macro economic conditions are positive, Bay Area home sales started showing a slow down in growth in Q3 of 2019 and it’s expected this trend could continue, though it won’t be as bad as was thought a year ago.

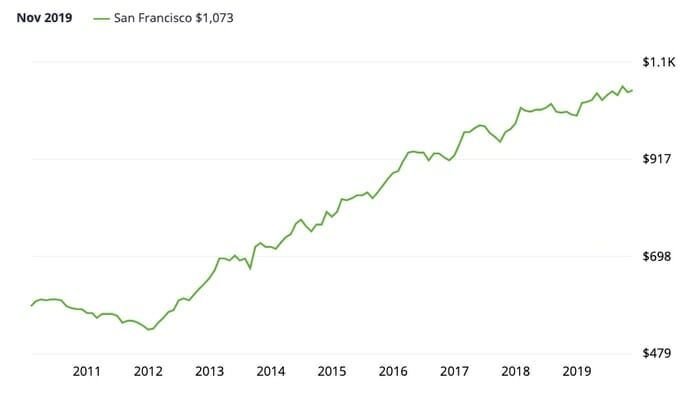

Bay area home prices remain high, but are slightly lower than last year.

Overall, Bay Area home prices are relatively flat, but dipping slightly from last year.

According to Zillow, San Francisco’s median home price is currently around $1.4million, which is about 0.1 percent higher than it was last year. In addition, Zillow predicts San Francisco home prices will rise another 0.7 percent this year.

https://www.zillow.com/san-francisco-ca/home-values/

However, in other Bay Area counties, prices are dipping slightly. In San Mateo, the median home price, currently at $1.4 million, according to Zillow, is down 1.6 percent from last year. Furthermore, Zillow predicts prices in San Mateo will fall another -1.4 percent this year.

https://www.zillow.com/san-mateo-ca/home-values/

In Santa Clara County, the median home price is $1.2 million, a decline of -8.1% from last year. And Zillow predicts Santa Clara prices will fall another -1.8% this year.

Buyers are paying below asking.

Another sign of this softening is a slight increase in the number of active listings that reduced their prices compared to last year, which is a good sign for buyers. In San Francisco, according to Compass, about 13 percent of listings reduced their prices compared to just over 12 percent last year.

https://www.bayareamarketreports.com/

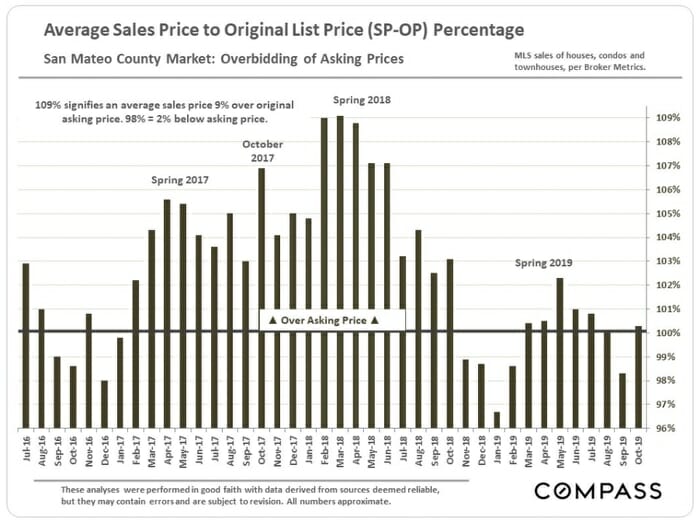

In San Mateo County, home buyers paid close to the asking price this year; whereas last year, they were paying about 3 percent over asking.

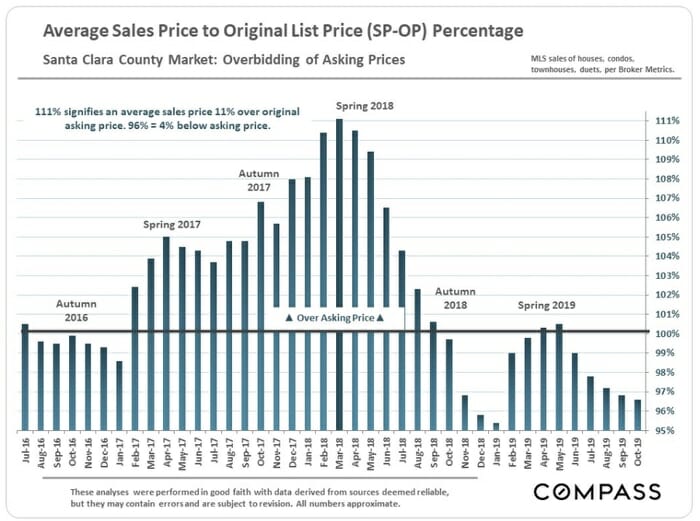

In Santa Clara County, buyers paid about 3.5 percent below asking prices this year as well, compared to just 0.5 percent below last year.

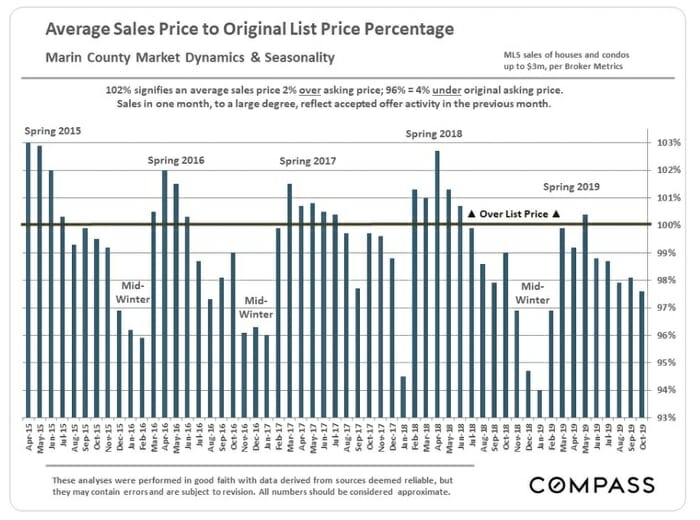

Marin County also saw a decrease in the sales-price to list-price ratio. Buyers in Marin paid about 2.5 percent below the list price this year compared to just 1 percent last year.

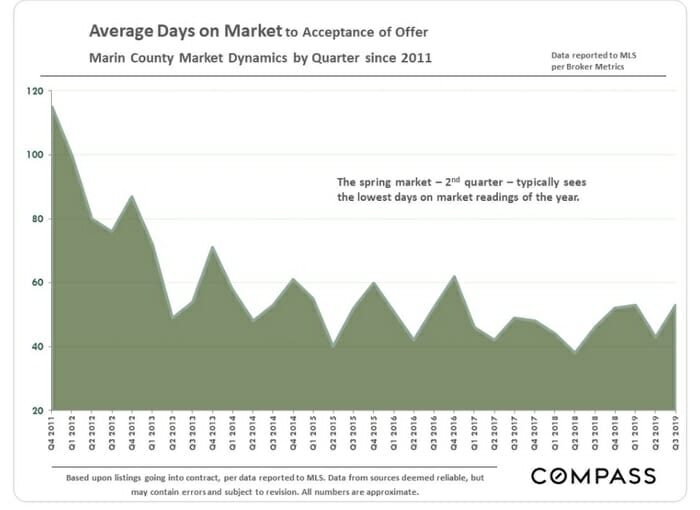

It’s taking longer for Bay Area homes to sell.

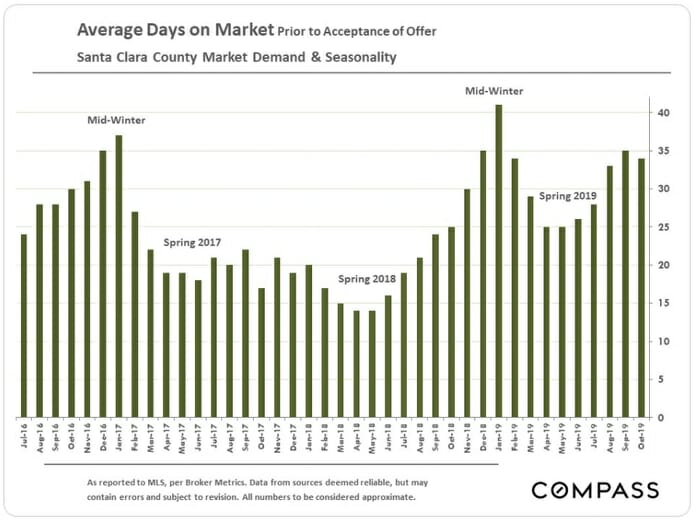

Another sign that the Bay Area real estate market is softening is that it’s taking slightly longer for homes to sell. This is another favorable factor for buyers, who have a little more time to decide this year.

In San Francisco, the average days on market was three days longer than last year, at 30 days vs. 27 days.

In San Mateo County, the average days on market in 2019 was also about three days longer.

And in Santa Clara County, the average days on market was about nine days longer than last year.

In Marin County, it took about six days longer for homes to sell than it did last year.

Although the Bay Area real estate market has slowed down from the lightning hot streak it was experiencing in 2018, there are still plenty of positive signals. Namely, strong economic conditions, including the labor market and low interest rates, should engender hope in buyers, sellers, and their agents. As CAR said in their recent Housing Market Forecast, 2020 may be “more difficult than 2019, but we’re less pessimistic.”

https://www.car.org/en/marketdata/marketforecast

It’s important that buyers’ agents make sure their clients understand all of the options that are available to them when it comes to financing a home purchase. According to CAR, 40 percent of buyers think they’ll need 30-100% down to purchase a home. And only 28 percent are aware of FHA-backed loans that let buyers put down as little as 3.5 percent. With some education and open-mindedness to possibilities, the dream of owning real estate in California in 2020 may not be as out of reach as many think.

Get the Most from the Bay Area’s Vibrant Housing Market

At Intempus Property Management, we’ve been proudly serving clients throughout the greater Bay Area and Silicon Valley for nearly two decades. We put our clients first, and our five-star customer reviews speak for themselves. So, whether you’re looking to buy, sell, or rent a property, contact us. One of our friendly team members will be happy to talk with you and answer any questions you have!