The Silicon Valley real estate market has long been a bellwether for the broader U.S. housing industry, known for its rapid growth, high demand, and sky-high prices driven by the tech boom. As of August 2024, the market continues to navigate a complex landscape shaped by a mix of economic factors, evolving buyer preferences, and macroeconomic shifts. With interest rates remaining a pivotal factor, potential homebuyers and investors are keenly observing the trends to make informed decisions.

In the past year, the Silicon Valley market has experienced fluctuations in home prices, inventory levels, and buyer activity, reflecting broader national trends and unique local dynamics. Despite challenges like rising interest rates and economic uncertainty, Silicon Valley’s real estate remains resilient, supported by the region’s robust job market, particularly in the technology sector. However, there are signs of a cooling market, with slower price growth and increased inventory, offering potential opportunities for buyers who had been previously priced out.

Market Trends and Analysis

Recent Trends in Home Prices

As of August 2024, home prices in Silicon Valley have seen a slight moderation after years of rapid growth. The median home price in the region now stands at approximately $1.52 million, reflecting a modest increase of 2.5% compared to the same period last year. This is a notable shift from the double-digit growth rates witnessed in previous years, indicating that the market may be reaching a plateau.

This cooling in price growth is partly due to the increasing unaffordability of homes in the area, which has led to a reduced pool of potential buyers. The shift is also influenced by rising mortgage rates, which have dampened the purchasing power of many buyers. However, the slight increase still signifies strong demand, particularly in prime locations close to tech hubs.

Inventory Levels and Their Impact on the Market

Inventory levels in Silicon Valley have been gradually increasing, providing some relief to the previously tight market. The number of homes available for sale has risen by 8% compared to the same time last year, bringing the total number of listings to around 2,800. This increase in inventory is giving buyers more options and reducing the intense competition that characterized the market in recent years.

The rise in inventory is a result of several factors, including higher mortgage rates, which have caused some potential sellers to delay their plans, and new construction projects that are adding to the housing stock. While the increase in inventory is a positive development for buyers, it has also led to longer days on market, with the average home now taking 45 days to sell, up from 32 days a year ago.

Mortgage Rates and Their Influence on Buyer Behavior

Mortgage rates have been a significant driver of market dynamics in 2024. As of August, the average 30-year fixed mortgage rate in Silicon Valley hovers around 6.75%, up from 5.3% at the beginning of the year. This increase has had a considerable impact on buyer behavior, particularly among first-time homebuyers and those seeking to upgrade to larger properties.

The higher mortgage rates have reduced affordability, causing some buyers to lower their price range or delay their purchase altogether. According to recent data, the number of mortgage applications in the region has dropped by 15% compared to last year, reflecting the challenging environment for prospective buyers. This decline in demand is contributing to the slower price growth and the increase in inventory levels.

However, despite the challenges posed by rising rates, Silicon Valley’s strong job market, especially in technology, continues to support housing demand. Many buyers are still willing to pay a premium to live in this region, particularly in areas close to major tech employers. As a result, while the market is cooling, it remains highly competitive, especially in desirable neighborhoods.

Silicon Valley Real Estate Market Data (Aug 2023 – Aug 2024).

| Month | Median Home Prices | Inventory Levels | Mortgage Rates (%) | |

| 1 | Aug 2023 | 1.48 | 2400 | 5.25 |

| 2 | Sep 2023 | 1.49 | 2500 | 5.3 |

| 3 | Oct 2023 | 1.5 | 2550 | 5.35 |

| 4 | Nov 2023 | 1.51 | 2600 | 5.4 |

| 5 | Dec 2023 | 1.52 | 2650 | 5.45 |

| 6 | Jan 2024 | 1.53 | 2700 | 5.5 |

| 7 | Feb 2024 | 1.54 | 2750 | 5.6 |

| 8 | Mar 2024 | 1.54 | 2800 | 5.75 |

| 9 | Apr 2024 | 1.53 | 2850 | 6.0 |

| 10 | May 2024 | 1.52 | 2900 | 6.25 |

| 11 | June 2024 | 1.52 | 2850 | 6.5 |

| 12 | July 2024 | 1.52 | 2800 | 6.75 |

| 13 | Aug 2024 | 1.52 | 2800 | 6.75 |

Key Statistics and Data

Detailed Breakdown of Recent Sales Data

As of August 2024, the Silicon Valley real estate market shows a nuanced picture when it comes to recent sales data. In July 2024, approximately 1,200 homes were sold across the region, a decrease of 12% compared to July 2023. This decline in sales volume reflects the broader trend of slowing buyer activity, driven by rising mortgage rates and affordability challenges.

Despite the overall decline in sales, certain areas within Silicon Valley have remained highly competitive. For instance, cities like Palo Alto and Mountain View continue to see strong demand, with homes often receiving multiple offers, though the bidding wars have become less intense compared to previous years.

Percentage Changes Compared to the Previous Month and Year

When examining the month-over-month changes, July 2024 saw a slight 3% decrease in sales compared to June 2024, continuing the trend of declining activity. However, the year-over-year comparison is more telling, with a 12% drop in sales indicating a more significant cooling in the market.

Home prices, while still high, have also shown signs of stabilization. The median sale price in July 2024 was $1.52 million, up just 2.5% from $1.48 million in July 2023. This moderate increase contrasts sharply with the double-digit growth seen in previous years and highlights the market’s shift toward more sustainable price appreciation.

Analysis of Different Property Types

The real estate market in Silicon Valley is diverse, with different property types experiencing varying trends:

Single-Family Homes:

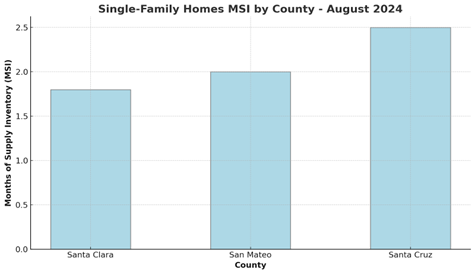

Single-family homes remain the most sought-after property type in Silicon Valley, particularly in well-established neighborhoods. In July 2024, the median sale price for single-family homes was approximately $1.78 million, representing a 3% increase from the previous year. However, sales volume for single-family homes has declined by 10% year-over-year, reflecting the broader market slowdown.

Condos and Townhomes:

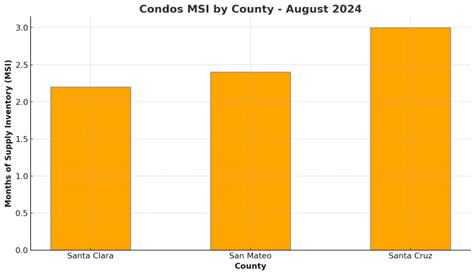

Condominiums and townhomes have seen a different trajectory. The median sale price for condos in Silicon Valley was $1.1 million in July 2024, showing a slight 1.5% increase from July 2023. Sales of condos, however, have dropped by 15% year-over-year, as rising mortgage rates and competition from single-family homes have affected this segment. Despite the decline in sales, condos remain a popular choice for first-time buyers and those looking for a more affordable entry into the market.

Luxury Properties:

The luxury market, defined as homes priced above $3 million, has been more resilient. The median price for luxury homes increased by 4% to $3.85 million in July 2024, compared to the previous year. While sales volume in this segment has also decreased by about 8%, the demand for high-end properties remains strong, particularly among tech executives and international buyers. This segment of the market is less sensitive to rising mortgage rates, as many purchases are made with cash or significant down payments.

New Construction:

New construction homes are contributing to the increased inventory levels. The median price for new builds is slightly higher than existing homes, at around $1.65 million. Sales of new construction homes have been relatively stable, with only a 5% decline year-over-year, as developers adjust their pricing strategies to attract buyers in a more cautious market.

Economic Factors Influencing the Market

The Role of Silicon Valley’s Tech Industry in the Housing Market

Silicon Valley’s housing market is inextricably linked to the performance of the technology sector, which serves as the backbone of the region’s economy. The tech industry’s growth has historically driven housing demand, with companies like Apple, Google, Facebook (Meta), and Tesla attracting a high concentration of well-paid professionals to the area. As a result, the demand for housing, particularly in areas close to these tech giants, has remained robust even during periods of broader economic uncertainty.

In 2024, the tech industry continues to play a pivotal role in sustaining the real estate market, although its influence has evolved. Recent trends show that while the demand from tech workers remains strong, the sector is experiencing a shift in dynamics. With some companies adopting hybrid or fully remote work models, there has been a noticeable change in buyer preferences. Many tech employees are now prioritizing larger homes with home office space, sometimes even opting for properties outside the traditional Silicon Valley boundaries, in neighboring regions where they can get more value for their money.

Impact of Local Economic Conditions on Real Estate Demand

Beyond the tech industry, local economic conditions in Silicon Valley also play a significant role in shaping real estate demand. As of 2024, the broader economic environment is characterized by a mix of growth and challenges, which are influencing buyer behavior and market trends.

Employment Trends:

The job market in Silicon Valley remains strong, with unemployment rates well below the national average. This robust employment landscape supports housing demand, as more people moving into the area for job opportunities need housing. However, the high cost of living, including housing costs, continues to be a barrier for some workers, leading to a bifurcation in the market where high-income earners dominate certain areas while others are pushed to more affordable regions or out of the market altogether.

Interest Rates and Inflation:

Rising interest rates have been a key factor influencing the real estate market in 2024. As the Federal Reserve continues to implement rate hikes to combat inflation, mortgage rates have increased, leading to reduced affordability for many potential buyers. This has resulted in a slowdown in the pace of home sales and a slight increase in inventory, as fewer buyers are able to qualify for mortgages at the higher rates.

Inflation, although moderating, remains a concern, impacting the cost of goods, services, and construction materials. This has had a knock-on effect on home prices and the pace of new construction, further complicating the market dynamics.

Local Policy and Regulation:

Housing policies and regulations in Silicon Valley also influence the market. Efforts to increase affordable housing and reduce barriers to new construction have been met with mixed results. While some cities have implemented policies to encourage higher-density development, resistance from local communities and the lengthy approval processes continue to limit the number of new housing units entering the market.

Additionally, property taxes and other local levies can impact the overall cost of homeownership, influencing demand. For instance, recent changes in property tax assessments have led some homeowners to reconsider selling, as the potential tax implications could erode their profits.

Migration Patterns:

Migration trends, both into and out of Silicon Valley, are another critical factor. While the region continues to attract talent from around the world, there has also been a noticeable outflow of residents seeking more affordable living conditions elsewhere. This out-migration, particularly among middle-income earners, has had a subtle impact on demand for mid-priced homes, while the luxury segment remains relatively insulated due to its affluent buyer base.

Future Outlook

Predictions for the Upcoming Months

As we move further into the latter half of 2024, the Silicon Valley real estate market is expected to continue its trend toward stabilization. While the explosive growth in home prices that characterized the past decade is unlikely to return, the market is expected to maintain steady, albeit slower, appreciation. The following predictions highlight the key trends anticipated in the upcoming months:

Moderate Price Growth:

Home prices are expected to continue rising, but at a more moderate pace compared to the past few years. The median home price in Silicon Valley is forecasted to increase by around 2% to 3% over the next six months. This growth will likely be driven by ongoing demand in prime locations and limited new housing supply.

Increased Inventory:

Inventory levels are likely to continue their upward trajectory, offering more choices for buyers. This increase in supply, combined with the gradual softening of buyer demand due to higher mortgage rates, will contribute to a more balanced market. As a result, the competition for homes may ease slightly, giving buyers more negotiating power.

Interest Rate Impact:

Mortgage rates are expected to remain a significant factor in the market’s dynamics. Should the Federal Reserve continue its policy of rate hikes, we can anticipate further increases in borrowing costs. This could lead to a continued cooling of buyer demand, particularly among first-time homebuyers and those on the margins of affordability.

Tech Industry Influence:

The tech industry’s performance will remain a critical driver of the housing market. As companies navigate economic uncertainties and shifts in work models, their influence on the housing market will persist. If tech stocks recover from recent volatility and companies expand their workforce, we could see renewed demand for housing, particularly in areas close to tech campuses.

Regional Variations:

While the broader Silicon Valley market may experience stabilization, specific sub-markets could see divergent trends. For instance, luxury properties in areas like Atherton and Los Altos Hills may continue to appreciate faster than the overall market, while more affordable segments might experience slower growth due to affordability constraints.

Expert Opinions on Where the Market Might Be Heading

Real estate experts and economists generally agree that the Silicon Valley market is transitioning from a period of rapid growth to one of sustained, but slower, appreciation. According to local real estate analysts, this shift represents a healthy rebalancing of the market, with fewer extreme price swings and a more predictable environment for both buyers and sellers.

Some experts believe that the market will continue to favor sellers in the most desirable areas, where demand remains high, and supply is limited. However, they also caution that the broader economic environment, particularly interest rates and inflation, could introduce volatility. If inflation continues to decrease and the Federal Reserve eases its rate hikes, there could be a resurgence in buyer activity, potentially reigniting price growth.

Conclusion

The Silicon Valley real estate market in 2024 is undergoing a significant transition, moving away from the rapid growth of the past decade toward a more stabilized and balanced environment. Although home prices continue to rise, the pace has moderated, signaling a shift in the market dynamics. This change offers both challenges and opportunities for buyers and sellers alike, with increased inventory providing more options and a slight reduction in the competitive intensity that has defined the market in recent years.

Mortgage rates have played a pivotal role in shaping buyer behavior, leading to a noticeable slowdown in sales volume. However, the strength of Silicon Valley’s tech industry continues to underpin housing demand, particularly in key areas close to major employers. As the market evolves, local economic conditions and shifting buyer preferences, such as the growing desire for homes that accommodate remote work, will continue to influence real estate trends in the region.

Looking ahead, the market is expected to maintain steady, if slower, growth, with continued interest in prime locations and an overall increase in inventory levels. For those navigating these changes, staying informed about the latest market developments is crucial. Whether you’re buying, selling, or managing a property, understanding these dynamics can help you make the best decisions. At Intempus Property Management, we offer expert guidance and personalized strategies to help you succeed in this evolving market. Our comprehensive services are designed to maximize property value and streamline operations, ensuring that you are well-positioned to achieve your real estate goals in Silicon Valley.